Featured

Table of Contents

Customers that sign up in the AMP program are not eligible for time payment plan. Web Energy Metering (NEM), Straight Gain Access To (DA), and master metered consumers are not currently qualified. For consumers intending on moving within the next 60 days, please relate to AMP after you've established service at your new move-in address.

One critical aspect of debt forgiveness connects to tax condition. The general rule for the IRS is that forgiven debt income is taxed.

The PSLF program is for customers who are used full-time in qualifying public service tasks. You would certainly need to be qualified when you have made 120 certifying payments under a qualifying repayment strategy while working for a qualifying company. Once you have actually satisfied this requirement, the balance on your Straight Lendings is forgiven.

How Questions You Must Ask Before Enrolling can Save You Time, Stress, and Money.

This is to encourage educators to offer in locations where they are most needed. IDR strategies to adjust your monthly student finance payment quantity based upon revenue and family members dimension. Any kind of superior equilibrium is forgiven after 20 or 25 years of qualified settlements, relying on the particular picked actual strategy.

Throughout the COVID-19 pandemic, the U.S. federal government implemented short-term relief measures for its federal trainee car loan consumers. The CARES Act suspended loan payments and set rates of interest at 0% for qualified government student loans. Although it was seen as a temporary alleviation procedure, it was not car loan mercy. Exclusive pupil fundings can not be forgiven under the federal funding mercy programs due to the fact that they are issued by exclusive lending institutions and do not bring the support of the federal government.

Paying off might involve a reduced interest price or more workable month-to-month payments. Great credit report is needed, so not all consumers may qualify.

The 8-Minute Rule for Does Debt Forgiveness Appropriate for You

Some private lenders offer case-by-case difficulty programs. These include temporarily making interest-only settlements, temporarily reducing payments listed below the contract rate, and even various other types of lodgings. Obtain versus those assets, like cash worth from a life insurance coverage plan, or take finances from relatives and close friends. Such alleviation is, nonetheless, temporary in nature and comes with its own set of dangers that need to be very carefully weighed.

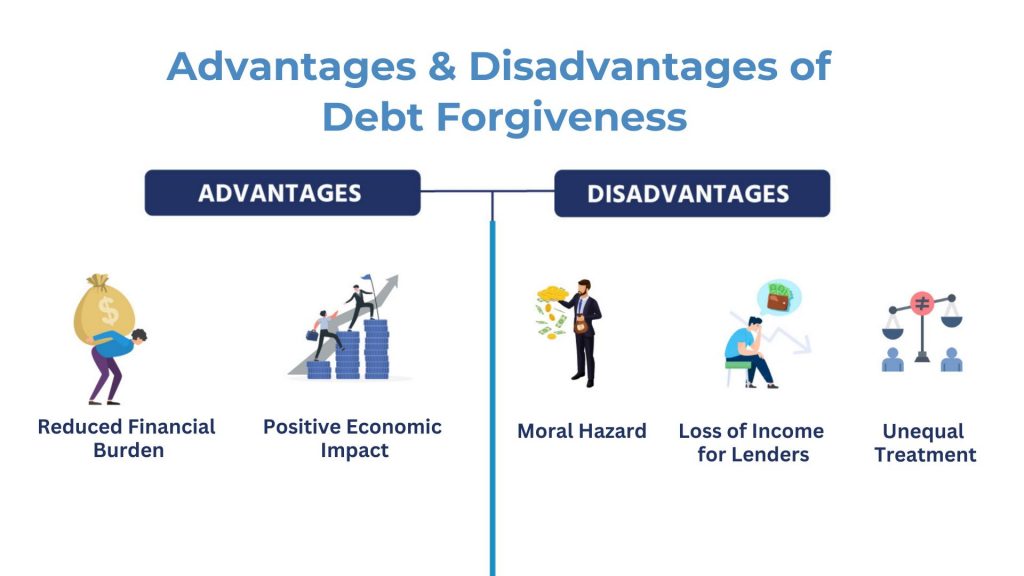

Some of the financial obligations forgiven, specifically derived from financial obligation settlement, likewise negatively influence credit history scores. Usually, the argument concerning financial debt mercy focuses on its long-term effects.

Mercy of huge quantities of financial obligation can have substantial financial effects. It can add to the national financial obligation or demand reallocation of funds from other programs.

Understand that your finances may be purely government, purely private, or a combination of both, and this will factor right into your choices. Forgiveness or payment programs can quickly straighten with your long-lasting economic goals, whether you're getting a residence or preparation for retired life. Know exactly how the various types of financial obligation relief may affect your credit rating and, later, future loaning capacity.

What Does Required Documentation When Pursuing Debt Forgiveness Mean?

Financial debt forgiveness programs can be a genuine lifesaver, however they're not the only way to deal with placing debt. They can decrease your monthly payments now and might forgive your staying debt later.

You can utilize economic applications to watch your spending and set cash objectives. Two methods to pay off financial obligation are the Snowball and Avalanche techniques. Both help you focus on one financial debt at a time: Pay off your smallest debts. Repay financial debts with the highest rates of interest initially.

Before making a decision, assume concerning your own money scenario and future strategies. This means, you can make choices that will aid your financial resources in the long run. Canceled Debts, Repossessions, Repossessions, and Desertions (for Individuals).

Unlike financial obligation consolidation, which combines several financial debts into a single loan, or a financial obligation management plan, which restructures your settlement terms, debt forgiveness straight decreases the principal equilibrium owed. This approach can provide prompt alleviation. There are some implications and possible threats to keep in mind prior to you choose to relocate ahead.

Financial obligation settlement involves working out with creditors to approve a lump-sum repayment or payment plan that amounts to less than the overall debt owed. The staying equilibrium is after that forgiven. You might select to work out a settlement by yourself or get the assistance of a financial obligation negotiation firm or a knowledgeable debt aid attorney.

Not just any person can acquire bank card debt mercy. You normally need to be in alarming monetary straits for loan providers to even consider it. In particular, creditors look at different variables when taking into consideration financial obligation forgiveness, including your income, properties, various other debts, capacity to pay, and readiness to comply.

8 Simple Techniques For What to Understand Throughout the Credit Counseling Services : APFSC Help for Debt Management Journey

In some cases, you may be able to solve your debt circumstance without resorting to personal bankruptcy. Focus on vital costs to boost your economic scenario and make room for financial debt payments.

Table of Contents

Latest Posts

9 Simple Techniques For The Benefits to Consider of Is It Legal to Get Out of Debt Without Paying? Here's the Truth : APFSC

The Of What Debt Counseling Usually Cost

The Best Guide To Pricing Clarity to Watch For

More

Latest Posts

9 Simple Techniques For The Benefits to Consider of Is It Legal to Get Out of Debt Without Paying? Here's the Truth : APFSC

The Of What Debt Counseling Usually Cost

The Best Guide To Pricing Clarity to Watch For